17 12 2024 - Media release

Screen Australia announces new Research Program: Drama Report 2023/24 reveals $1.7 billion spent on drama production in Australia

Thou Shalt Not Steal

Screen Australia has announced an expanded research program to empower the local screen industry and related partners. In addition to publishing drama and documentary trends, a new Screen Currency report will provide insights into the economic and cultural value of Australian screen and games production. A suite of audience research projects, the Viewfinder series, will also deepen our understanding of audience behaviour and attitudes, supporting the industry to respond to the evolving media landscape.

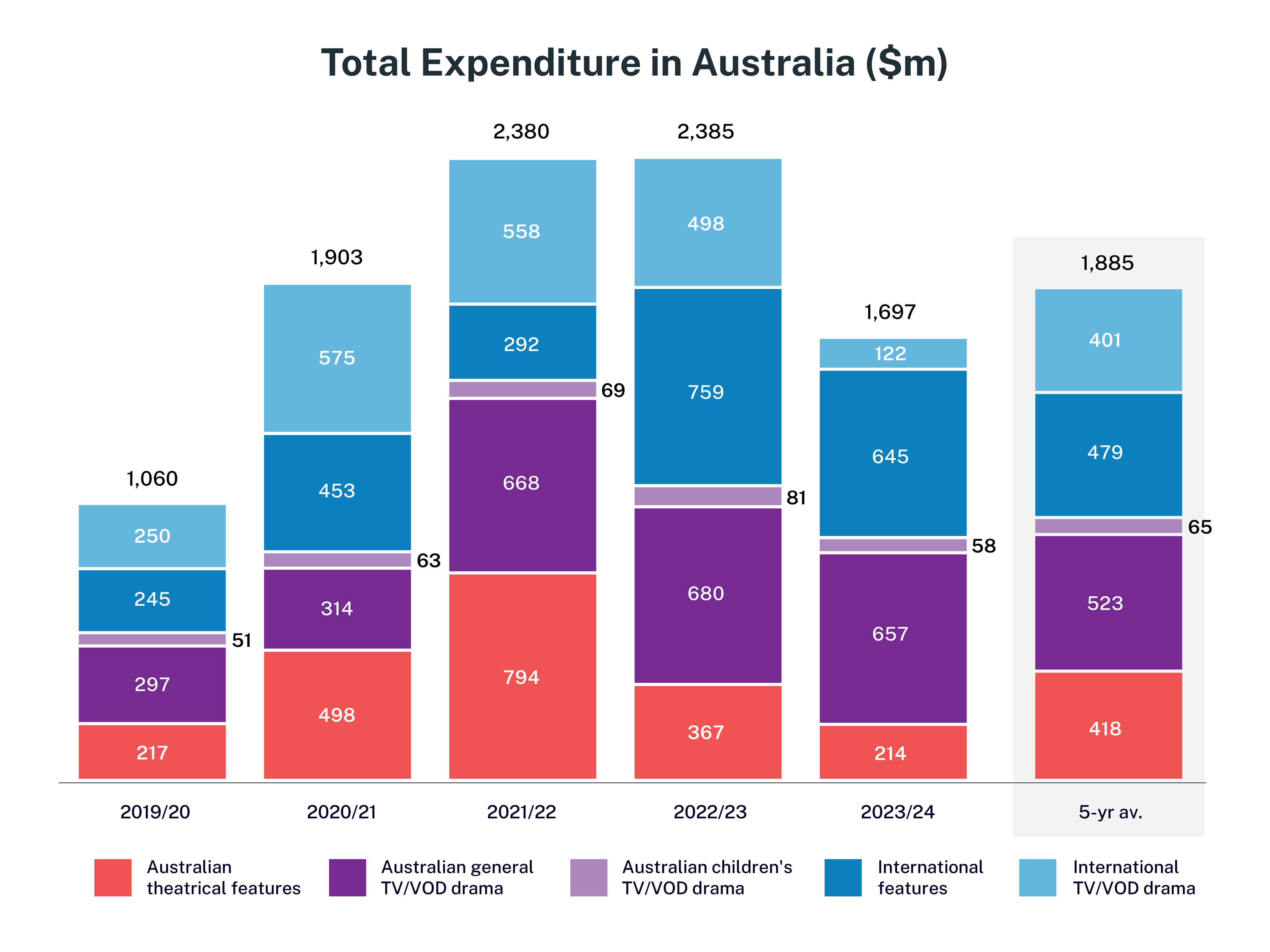

As a first component of this program, a new-look interactive version of the Screen Australia Drama Report was released today. The data shows a total of $1.7 billion spent on drama production in Australia, with $929 million dedicated to Australian stories. This marks a 29% total decline compared to last year, primarily due to a reduction in high-budget production activity across international TV and Australian theatrical features.

Global economic conditions continue to impact screen production, with disruption across distribution platforms, business models and audience shifts influencing the market. The past year also saw US industrial action and uncertainty around changes to the Location Offset incentive, which may have led to international projects being impacted during 2023/24.

Screen Australia CEO Deirdre Brennan says “Expenditure of $1.7 billion on 169 Australian and international drama productions represents a solid result after a three-year peak driven by Australia’s status as a COVID-safe filming destination, streaming growth and a number of high-budget theatrical features.”

“The Drama Report is one of many resources providing insights into the opportunities and challenges facing the Australian screen sector. This year’s results confirm key trends in domestic activity, a contraction of free-to-air commercial TV drama and the increasing role of SVOD commissioning. Children’s content continues to face significant pressure and remains reliant on government support, so we’re working to broaden the opportunities for development of Australian kids IP. We will also explore the needs of feature filmmakers working in the $1-5 million budget range, dominant again in this year’s data.”

“We understand how competitive funding is, with Screen Australia supporting 27% of the direct funding applications received for scripted content in 2023/24. In an environment where international financing is also increasingly harder to source, we need to pull together as an industry to ensure the sustainability of the sector. Despite these challenges, we’re optimistic about the future and confident that there will be an uplift in production in the year ahead. Screen Australia will continue to collaborate with industry to identify growth opportunities and ensure Australian screen stories thrive.”

This year, the Drama Report is presented via an interactive Power BI dashboard, with a user guide available here.

.jpg)

.jpg)

2023/24 Drama Report Key Findings

- $1.7 billion spent on 169 productions, 55% coming from Australian titles, primarily general TV/VOD drama.

- $929 million was spent on Australian titles, down 18% on last year, due to fewer high-budget Australian theatrical features, such as Mortal Kombat in 2022/23, Furiosa in 2021/22 and Elvis in 2020/21.

- 36 Australian theatrical features commenced production, with a total spend of $214 million. While the number of titles increased by two, there was a 42% decrease in spend from the previous year. Features in the $1-5 million budget range dominated.

- $657 million was spent on 55 Australian general TV/VOD drama titles, consistent with the previous year. This includes:

- Subscription TV/ SVOD – $467 million spent on 27 titles, marking a 17% increase in spend and a 29% increase in the number of titles.

- FTA TV/BVOD titles – spend was down 32% at $188 million, across 15 titles.

- Children’s content continues to be under significant pressure, with eight titles entering production, down from 12 last year. Expenditure in this category dropped 29%, with the number of hours of children’s content decreasing by 42%.

- Producer Offset financing contributed $245 million of investment across all drama production in 2023/24.

- The Producer Offset accounted for 34% ($75 million) of financing for Australian theatrical features, while international investment in Australian features was at its lowest point since 2014/15.

- Investment from Australian broadcasters, VOD platforms and distributors increased by 36% on last year. This accounts for a third of TV/VOD finance in 2023/24 — showing a stronger local contribution to production costs.

- Australian independent and global streaming platforms contributed the largest share of investment (65%) in TV/VOD drama across 26 titles. Its investment value and number of titles both increased this year.

- The proportion of spend for states and territories was 47% in New South Wales, 19% in Victoria, 18% in Queensland, 5% in South Australia, 5% in Western Australia and 6% in the combined states and territories – Australian Capital Territory, Northern Territory and Tasmania.

- Expenditure by location is cyclical in nature. We saw notable growth, particularly in:

- Western Australia, where spend surged to $77 million — more than three times last year’s figure.

- A record combined spend of $105 million in Northern Territory, Tasmania and the Australian Capital Territory, mostly driven by production activity in the Northern Territory and Tasmania.

- $768 million of total expenditure in Australia came from 70 international productions, a 39% decrease from last year. This was driven by less international TV/VOD production.

- PDV expenditure on both Australian and international titles totalled $589 million, down 17% from last year’s record high but still 15% above the five-year average.

ABOUT THE DATA

The Drama Report uses industry data to provide an overview of the production of local and international feature, TV/VOD and children’s drama titles, as well as PDV activity. All production expenditure is allocated to the year in which principal photography began. PDV employs a secondary method of analysis, which is outlined in the PDV section in the report. ‘Drama’ refers to scripted narratives of any genre. Titles in the report are categorised according to the platform they were first released on. A full list of titles included is available in the report.

RESOURCES

- Read the full Drama Report here

- Images for media editorial use available to download here

Download PDF

Media enquiries

Maddie Walsh | Publicist

+ 61 2 8113 5915 | [email protected]

Jessica Parry | Senior Publicist (Mon, Tue, Thu)

+ 61 428 767 836 | [email protected]

All other general/non-media enquiries

Sydney + 61 2 8113 5800 | Melbourne + 61 3 8682 1900 | [email protected]